| Issue Brief |

Long-Term Care Financing Reform Proposals That Involve Public Programs |

|

JULY 2021 |

|

Download a PDF version here. IntroductionThe aging of the U.S. population, along with changing socioeconomic factors, has created an increased need to rethink how long-term care (LTC)1 services are delivered and financed. The current system of LTC financing and delivery—a mixture of individual self-funding, private long-term care insurance (LTCI), and public programs— has many gaps and inefficiencies. The inability of many to afford private LTC (as well as a sense that LTC might be beyond an ability to afford) or to accumulate enough savings to fund their future LTC needs has led some policymakers to focus on public programs to help address the growing need for long-term care services. This issue brief discusses:

This issue brief concludes with a side-by-side assessment of some federal and state, reform programs, and proposals with consideration of the assessment criteria. |

Foundational Work From the American Academy of Actuaries

The American Academy of Actuaries’ (“Academy”) LTC Criteria Work Group, building upon discussions held during the 2012 roundtable “A National Conversation on Long-Term Care Financing,”2 identified seven criteria that can be considered in formulating and evaluating reform proposals. These criteria were subsequently published in a 2016 brief3 and remain relevant today.

By way of summary, the criteria are as follows:

- Level of Coverage—How many people are expected to be covered / eligible and the attributes of those people.

- Comprehensiveness of Benefits—A clear definition of the amount of risk that is covered by the system, including benefit limitations, location of care, and eligibility for care.

- Quality of Care Benchmarking and Monitoring—A framework that would include measures for patient and family centeredness, transitional care processes, performance outcomes, safety, timeliness, efficiency, equity, and cost effectiveness.

- Understandability and Choice—While recognizing that the needs of individuals vary widely, choices should be easy to assess, and educational tools are provided.

- Affordability—The available and continuing funds a purchaser would be willing to “give up” as a contribution in order to purchase an LTC solution, including income and assets, after accounting for necessities.

- Risk Management and Cost Control—An evaluation framework to identify, assess, measure, mitigate, and manage risk; utilizing a projection model, and sensitivity and stress testing. Cost controls should align the interests of all stakeholders.

- Financial Soundness and Sustainability—Ability to deliver on what is promised, well into the future, with consideration of funding structure, investment strategy, complexity of the program, and interaction with other benefits and programs.

What Already Exists

Because Medicare and Medicaid already provide health coverage and some LTC benefits to broad segments of the populations, LTC reform proposals that involve these two programs are often a starting point for reform considerations. Over the years, changes to Medicare and Medicaid, which must be enacted by the U.S. Congress as amendments to the Social Security Act, have been specific to address problems or gaps rather than fundamentally changing those programs, leaving their initial intent intact.4 Therefore, it is reasonable to anticipate that reform proposals to add long-term care services to Medicare or Medicaid would likely consider both the intent and financing of these programs, as well as how well the proposals address the demographics, needs, and preferences of the target population. Furthermore, there should ideally be an examination of the impact of these proposals on the Medicare and Medicaid programs.

Among the first national social insurance programs in the U.S. were those created through the Social Security Act of 1935 with the goal of ensuring economic security for Americans. With the further rapid industrialization and urbanization of much of the country, there was concern that middle-class Americans would need a source of income long after they retired. Medicare and Medicaid were established in 1965 by amendments to the Social Security Act to address specific economic needs. Medicare was created to address the aging of the population, the cost of health care, and the lack of access to retiree medical benefits. While many state and local governments may have had public assistance programs, Medicaid was created as an option for all states to gain access to federal grants to provide health benefits for the poor.5

Medicaid

The intent of Medicaid was to be the insurer of last resort for the poor and medically needy. While eligibility criteria vary by state, people do not generally qualify for the LTC portion of Medicaid unless they meet both a very low income and an asset requirement. Coverage of nursing facility care is available in all states. Home care services are available in many states for those considered nursing facility-eligible, but qualification requirements can be stringent.

States can add through waivers personal care and other long-term support services to the standard Medicaid benefits.6 The addition of optional benefits or home and community- based waiver services are geared toward improving quality of life and providing cost-effective alternatives to being in a nursing facility. Such additional or optional services vary greatly by state and range from a full reliance on facility care to a very high use of home health care services for Medicaid-eligible beneficiaries. As the financing of Medicaid is shared between the federal and state governments, and program benefits vary greatly by state, any changes to benefits or eligibility rules could impact state and federal budgets, either positively or negatively.

Medicare

Medicare is intended to benefit all people 65 or older or those who are permanently disabled. Original Medicare is made up of two parts, Part A and Part B. Part A (compulsory Hospital Insurance program) is financed through a payroll tax (equally between employer and employees) and covers hospital inpatient care and post-acute care following an inpatient stay. Nursing facility and certain home care services are covered after a hospital stay but are generally limited to 20 days, with partial coverage for days 21-100. These benefits are not intended to address long-term needs. Health benefits under Part B (Supplementary Medical Insurance) are financed through enrollee premiums (about 25%) and federal general revenue (about 75%). Enrollees also contribute through cost-sharing when they use benefits. Some home care benefits are provided under Part B, but like those under Part A, they must generally be for skilled care only and for a predictable and finite period of time. Services like personal care and assistance with meals are not covered.

Medicare beneficiaries can elect coverage in a number of ways including:

- Medicare benefits only,

- Medicare benefits supplemented with a private Medigap plan, or

- Medicare Advantage (MA) plans, which may restrict covered providers but frequently provide more comprehensive benefits than Medigap plans. Medicare Advantage Plans have the option to waive the three-day hospital stay required for Medicare nursing facility and home care services.

LTCI Partnership Programs

A public/private program, the Long-Term Care Insurance Partnership Program, began with four states implementing Partnership Qualified LTC policies in the early 1990s. In 2006, the Deficit Reduction Act authorized additional states to develop Partnership Qualified plans. A majority of standalone LTC insurance products offer a Partnership Qualified option, which allows the insured to qualify for Medicaid LTC funds with less strenuous asset spend-down requirements once the LTC insurance benefits have been exhausted. These policies require that the private solutions pay first and therefore reduce the reliance on Medicaid.

Initially, the products purchased under the Partnership programs generally required the purchase of a 5% benefit inflation feature with some older issue age exceptions. This requirement has had two inadvertent consequences. First, it often puts the premiums for such coverage out of reach for those that the program is intended to cover. Second, actual inflation has been less than 5% for many years and therefore individuals were required to buy protection that exceeded anticipated costs. Recently, states have been examining the need for the 5% annual inflation requirement with at least 26 now allowing alternative options such as inflation options of 3% or less.

Assessment of Reforms and Proposals

Several reforms and proposals have emerged in recent years, at the state and federal level. This section outlines a few of these proposals and highlights some of the elements that would need further refinement and consideration.

State Programs

Many states have initiated and implemented programs and approaches to help reduce the burden of LTC support needs of current and future eligible participants on Medicaid funds. These initiatives either improve on Medicaid delivery and expense of care or provide for a social insurance-based program.

Lowering the Medicaid program per-eligible costs, for example, by increasing the availability of home health care services, can provide an opportunity to expand the reach of Medicaid-provided care and assist a greater number of eligible participants efficiently. On the other hand, consideration should be given as to the impact of increased eligibility and services on overall program costs. Either way, the current means-tested and mostly facility-based requirements7 limit the program’s reach and impact on families.

Several states (such as California, Illinois, Hawaii, Minnesota, and Washington) have examined, or have begun to examine, the potential for an LTC social insurance program. Critical funding decisions in these considerations have included whether the programs should be mandatory and whether they should be funded through the general tax structure or through a specific tax. In spring 2019, such a program was signed into law8 in Washington, with an increase in payroll taxes to fund the benefits.

The experience in Washington highlights several reasons why the program was adopted, including:

- Lack of participation in the private market, and lack of public options

- Increased need, as the senior population continues to grow, and reduced proximity of family caregivers

- Current and projected strain on state operating budgets to provide long-term services and supports

Key features of the Washington program include:

- Program eligibility—Starting in 2022, Washington residents are eligible if they are age 18 or older and have paid payroll taxes either (i) for 10 years without an interruption of five consecutive years, or (ii) during three of the past six years. For purposes of eligibility, the years in (i) and (ii) must include at least 500 hours of work per year.

- Funding—Premiums are levied based on a payroll tax, currently 0.58%.

- Opt-out provision—Currently individuals who have previously purchased private LTC insurance may be eligible to opt out of the program.

- Broadly defined benefits—Set to align with Medicaid eligibility triggers, benefits are paid directly to the provider for a wide variety of approved services.

- Benefit maximums—Starting in 2025 the lifetime benefit maximum of $36,500 will be indexed each year at the greater of the Washington state consumer price index and 3%.

At $100 per day, the law provides coverage that would last approximately one year. One year of LTC coverage provided by a public program may potentially provide an attractive risk mitigating point of penetration for the private market. A coverage extension product could potentially be priced more attractively for insureds at different income levels. However, based on published cost of care data,9 the state median annual cost of care in Washington is more than double the available lifetime maximum of $36,500. In addition, private LTC insurance benefit eligibility triggers are not aligned with Washington’s benefit eligibility triggers.

Potential benefits of the Washington program may include:

- Alleviate Medicaid strain

- Flexible benefits

- The benefit trigger can provide assistance earlier than tax-qualified LTC insurance products10

Concerns regarding the program include:

- Residents that leave Washington state either before benefits are needed or while receiving care are not covered

- Current retirees, non-W-2 employees, spouses and dependents who do not qualify on their own are not covered

- The dollar amount and the potential duration of benefits is limited

- The program does not coordinate with Medicare or private LTC insurance so coverage could be duplicative

Medicare Program Initiatives

As discussed previously, Medicare covers limited LTC services. However, because Medicare is a well-established government program that is largely targeted toward the elderly, many LTC reform proposals attempt to use the Medicare chassis in one way or another. For many years, options to add LTC services to the standard Medicare required benefits were proposed, however, recent proposals have taken the approach of adding LTC benefits to existing Medicare Advantage and Medigap (aka Medicare Supplement) plans as an optional benefit.

LTC in Medicare Advantage and Medigap Plans

In April 2018, the Centers for Medicare & Medicaid Services (CMS) provided guidance to Medicare Advantage plans with respect to their contract year 2019 plan bids. The guidance clarified that plans could provide certain LTC benefits as a supplemental benefit for individuals who need assistance with ADLs or IADLs.11 These supplemental benefits that some MA plans offer are necessarily limited due to cost and potential adverse selection. In 2019 less than 1% of plans offered these supplemental LTC benefits, however, 2020 did see a significant increase from 2019. Some of the plan offerings include custodial care provided with adult day care, in-home palliative care, and support for caregivers.

LTC can be very expensive and offering such benefits under a Medicare Advantage plan is likely to significantly impact MA plans. Since the adding of LTC benefits may have a significant impact on the MA plans, the proposals under the most recent CMS guidance necessarily provide for limited LTC benefits. Additionally, adding similar benefits under Medigap plans are under consideration. One such recent proposal in the state of Minnesota would provide a home care benefit that may include up to $100 per day of personal care services.

There are many considerations with respect to offering LTC as part of a Medicare Advantage or Medigap plan:

Adverse Selection

Optional LTC coverage in Medicare Advantage and Medigap plans could experience the effect of adverse selection as those currently in need of care or expecting to need care soon would seek coverage from a plan offering the benefit. This adverse selection could significantly increase costs and premiums and cause the carrier to further limit or drop the LTC benefits.

Voluntary insurance coverages (such as private LTC insurance policies) use tools such as underwriting and premium rate classes to address adverse selection concerns. Such tools cannot be used by Medicare Advantage or Medigap plans by statute to reduce adverse selection related to LTC coverage. In the absence of underwriting, offering a very small benefit or introducing a cost-sharing component, such that the premium is minimal, may mitigate some of the adverse selection (but conversely, may not be very attractive to members).

If the LTC coverage requirement is mandated for all Medicare Advantage and Medigap plans, premiums may increase significantly and drive consumers toward coverage options with fewer overall benefits and greater participant cost-sharing for both their acute care and LTC needs. This would impact consumers who look to Medicare for their primary care and acute care needs.

Medicare Advantage and Medigap plans may offer approaches that could mitigate adverse selection issues. Care management and wellness benefits that contribute to the overall health of the individual and reduce care needs may have the potential to offset some of the above adverse selection concerns. Additionally, there may be benefit design features that could reduce the impact on premiums to maintain affordable overall coverage.

Understandability & Limitations

There is also risk that individuals with LTC coverage through their Medicare Advantage or Medigap plan may believe they have taken care of planning for all their potential LTC needs. This is likely not true, even if the Medicare benefits are expanded beyond the current limited offerings. As Medicare Advantage Plans only cover LTC costs during the plan year, the uncertainty regarding the pricing and availability of such benefits in subsequent years is a concern.

Currently, LTC benefits are not required benefits within Medicare and the offering by Medicare Advantage plans is just an option. Thus, while the insured may have benefits available in the coming year, they may be discontinued in future years, leaving them without protection. Also, the health insurance carrier could leave the overall Medicare Advantage coverage region. These factors underlie why LTC consumers need to plan carefully for the entirety of their retirement years.

An additional significant limitation is that Medicare Advantage and Medigap plans begin when one becomes Medicare-eligible. Relying on these programs for LTC coverage is potentially risky should an LTC need emerge before reaching the age of Medicare eligibility.

Pricing and Market Impact

LTC coverage is typically priced using level issue-age based premiums so that the steep increases in expected costs at future attained ages can be prefunded. This pricing basis seeks to reduce significant increases in premium as insureds age. On the other hand, premiums for Medigap plans are typically repriced for medical trend annually and do not typically assume that premiums will be level. Merging these two pricing structures together and the steep slope of the attained age benefit levels can create complications that may impact solvency and sustainability of the aggregate program. Additionally, LTC consumers need and use long-term care services in a variety of ways. Unlike with acute health care needs, families can care for one another. Mandating benefits for custodial care can be considered unreasonably prescriptive for those with care alternatives. These concerns could be mitigated with a catastrophic benefit program where eligibility is limited to severe claim conditions. This structure could reduce the impact of costs that increase significantly as members age.

Proponents of adding LTC benefits to Medicare Advantage and Medigap Plans cite the ability for consumers to receive acute health care needs and LTC needs through one program. Additionally, a health plan can manage the overall care of the insured and with this coordination may reduce the overall costs of care. Such plans may also be able to offer additional LTC insurance products that coordinate with the included base LTC benefits.

Some potential advantages to offering LTC within a Medicare Advantage or Medigap plan:

- Medicare eligible consumers could purchase an “integrated plan” where both the acute care and LTC needs are met.

- At the time of enrolling in Medicare, consumers can address both their senior health and LTC needs therefore encouraging discussion around addressing their LTC needs.

- As Medigap policies are standardized, so too would the LTC cost components of the product.

- While the benefits may be limited, a short-duration benefit covers most of the consumer risk.

Some potential disadvantages to offering LTC within a Medicare Advantage or Medigap plan:

- Unless mandated, future insureds would be unable to rely on the LTC benefits if they are not required Medicare benefits and therefore the insurers may choose to reduce or remove the LTC benefits in the future.

- LTC expenses vary significantly across the country; some regions have facility costs that are more than double others. If LTC benefits are added as a required Medicare plan benefit the overall premiums for Medicare will increase disproportionately for less expensive regions than others. This may then price the much needed Medigap products out of reach of some consumers.

In either case, offering long-term care benefits in Medigap and/or Medicare Advantage plans may allow for better coordination of care but may also increase the cost of these plans to the consumer. The effect of adverse selection and the increase in premiums with even a limited level of LTC benefits could be partially mitigated if the LTC benefits were mandated for all plans and all participants.

Public-Private Initiatives

Some initiatives that coordinate public and private elements are either in place or have been proposed to reduce the reliance on or need for public programs for meeting LTC needs. These initiatives may coordinate with existing public programs, offer an enhancement or an additional public program, or offer policy initiatives that may increase the use of private solutions and therefore increase the effectiveness of public programs. They are generally aimed at reducing the demand on public funds for LTC needs and increasing LTC coverage for participants. The following summarizes a few of these initiatives and proposals.

Private Research Proposals

One proposal with a universal LTC insurance program12 advocates for the following three essential features:

- A universal approach to coverage—Coverage would be mandatory and spread costs over a large population, potentially lowering expenses for individuals and increasing overall coverage for LTC expenses.

- A catastrophic benefit period—Benefits would begin after individuals had financed their own care for two years through private LTC insurance or out-of-pocket spending.

- A managed cash benefit structure—Beneficiaries receive a cash payment to purchase services and supports.

While the proposal includes essential features of a system, many questions and issues still need to be addressed:

The proposal includes a new payroll tax to finance the catastrophic benefits. Details are not available regarding the size of the cash benefits that can be provided given various payroll tax percentages.

- The proposal does not specify the benefit eligibility criteria.

- Whom does this program benefit?

- Is a mandatory program politically viable?

- The proposal does not address coordination with Medicaid and Medicare benefits to maximize efficiencies.

- Can the program simultaneously provide new support for families and reinvigorate the private LTC insurance market?

- Is two years the optimal benefit to balance needs with appropriate financing?

- Does a cash benefit structure with the same level of cash benefits regardless of location provide for a meaningful benefit? Should the cash benefit have an indexing option?

- Will a universal national approach coordinate Medicaid programs that vary by state?

Another proposal13 to promote comprehensive insurance protection, focused on middle- income individuals, builds on the prior proposal. The authors of the proposal used a micro simulation model to project the proposal’s impacts on people, programs, and overall public spending for the population aged 65 and over. Features of this proposal include:

- A catastrophic (i.e., unlimited) benefit period would begin after an income-related waiting period is satisfied. The proposed waiting period structure is:

- One year for people with lifetime income in the lowest two quintiles

- Two, three, and four years for people with incomes in the third, fourth, and highest quintiles, respectively.

- Eligibility is phased in over 10 years. As a result, participants will need to work and contribute payroll taxes for 40 quarters after the law is enacted to become eligible for benefits.

- Benefit trigger is two or more ADLs and/or severe cognitive impairment (CI), which is consistent with the HIPAA benefit trigger.

- Benefits are equal to $110 (in 2014 dollars) per day, cash benefit paid on a weekly or monthly basis. Benefits inflate at the rate at which hourly rates for home health care (HHC) workers inflate.

- Financing will come from a premium surcharge on the Medicare tax, currently estimated at 1%.

The analysis surrounding the proposal projects the following benefits of this program to include:

- Significant additional dollars injected into the LTC system, enhancing benefits for people with impairments of long duration, reducing unmet LTSS needs and mitigating burdens facing family caregivers.

- Reducing the financial burden of LTSS felt by millions of families by an estimated 15%.

- Reducing Medicaid’s fiscal burden on states by almost a quarter, due to substitution of new public benefits plus potential impacts of higher private insurance take-up.

- Reinvigorating the private LTC insurance market including the possibility that new carriers would enter the private LTC insurance market given that the tail risk is covered by a public program.

Nevertheless, many questions and issues still need to be addressed:

- Will the income-related waiting period be effective enough to justify the administrative complexity?

- The program may face significant political hurdles given the highly progressive financing mechanism.

- Is a mandatory program politically viable? The expected number of persons covered by a voluntary program or a program that allows participants to opt out would be much more limited.

- The proposed program does not address the LTSS needs of nonworking individuals and spouses, nor individuals under age 65, and does not solve the LTSS problems of currently or near-term elderly.

- In addition, the program will not provide benefits to anyone in the near term as program eligibility requires collection of 10 years of payroll taxes.

- A cash-based benefit of $110 per day regardless of region may be limiting in some locations and excessive in others. For example, the cost of one hour of care across the country ranges from $17 to $33 in 2019 numbers.14

- The elimination period for individuals is uncertain—and how would private insurance be coordinated?

- Will education materials be available to individuals about the program including the expectation that they will need to provide for themselves during the elimination period?

Enhancements to the LTC Insurance Partnership Programs

Many states have made enhancements to their LTC Insurance Partnership Programs to reduce the required annual inflation protection provision. A few states are also proposing additional enhancements to allow hybrid life/LTCI solutions to qualify and to reduce the requirements on all LTCI insurance solutions to be considered Partnership-eligible. As described above, the Partnership program is a state-based initiative that coordinates with Medicaid and has expanded to all states since it began in 1994. The program was structured to incentivize individuals, who would rely on Medicaid if a catastrophic LTC need were to occur, to purchase private LTC insurance. However, for many reasons the targeted population has not purchased LTC insurance and has historically not benefited as much from the Partnership features.

Potential advantages of these enhancements enable the Partnership Programs to reach the population it was initially intended and include the following:

- The cost of long-term care insurance is reduced when reducing the required annual inflation provision from 5% to 3% or lower. A 5% provision, as required in half of the states, is unaffordable for most.

- With increasing the policies that are eligible for the Partnership Program, Medicaid programs would be saved the expense of long-term care costs as the participants who are most likely to use Medicaid for LTC are able to participate.

- Consistent program requirements and reciprocity rules across the states provide assurance consumers are protected if their state of residence changes.

Some questions remain, including:

- Will the private LTC insurance market offer Partnership Program-eligible products, standalone LTC, or hybrid products that will be affordable and reach the potential Medicaid LTC recipients?

- Will benefits offered under the Partnership programs keep up with inflation so that out- of-pocket costs will not be required by participants?

- What enhancements to a Partnership Program would cause the private insurance and employer markets to expand?

- Will Medicaid programs continue to offer benefits that are consistent with LTC insurance products so that claimants are covered by Medicaid when they transition from private insurance?

Retirement Plan Distributions / Use of LTC Savings Accounts and Health Savings Accounts

While individuals under age 65 can have disabling chronic illnesses, the incidence of LTC increases significantly for ages 75 and beyond. Therefore, people in retirement face an increasing risk to their own financial wellbeing and that of their families. To that end, many have proposed options to encourage use of retirement assets to mitigate this retirement risk.

In general, such proposals include the use of tax-qualified plans to fund LTC insurance premiums. One proposal is to use qualified plan dollars such as LTC Savings Accounts, which are similar to current Health Savings Accounts (HSA) but for LTC expenses and insurance premiums. Some proposals have focused on allowing for tax- and penalty-free withdrawals from Qualified Retirement Accounts to pay LTC premiums.

The latter proposals would limit the annual amount that could be withdrawn and require that these funds be used for the purchase of a qualified LTC insurance contract. The tax- and penalty-free withdrawals for a long-term care product would be limited to ensure broad participation. Advantages of the approach include that it would encourage people to think about their retirement funding as a single source and plan for their overall retirement needs, including LTC expenses. Such an approach would also allow for needed product innovation and flexibility to optimally take advantage of timely withdrawals from retirement accounts. In addition, this approach could lead to options being offered in the group market where people tend to initiate and maintain their retirement plans and insurance needs. Proponents further point out that the approach is indeed portable as transfers from a 401(k) plan to an Individual Retirement Account (IRA) retain the ability to make these withdrawals. Finally, age 50 is a time when qualified plan contributions can be increased and is often a time when retirement planning efforts increase. This ability to increase contributions can assist the consumer with replacing monies withdrawn for LTC premiums and expenses with increased contributions.

Disadvantages of these proposals revolve around the fact that Americans are generally not preparing for their retirement sufficiently. Providing access to their existing funds could further deplete their retirement savings. However, the expectation is that such an encouragement could enhance planning and that a cap on both the annual amount and the lifetime amount that can be withdrawn would lessen this concern.

Proposal Comparison

The comparison below uses the Academy LTC Criteria Work Group criteria to evaluate several of the proposals discussed in this brief. Each of the seven criteria elements are listed with relevant questions to consider for each reform proposal. This comparison is provided at a high level and is not intended to be exhaustive.

Criteria #1: Level of Coverage—Does the proposal broadly increase the expected population covered?

Adding LTC benefits to Medigap and Medicare Advantage Plans

The entire Medicare population would have access to benefits from either a Medigap or Medicare Advantage Plan. However, individuals must elect to pay higher premiums to receive these benefits. The program would not broadly increase the covered population if seniors do not choose these options.

The Washington State Program

Coverage will be expanded in the state of Washington for residents who meet the program’s work requirements. The program will not address the needs of current or near-term elderly.

Partnership Program Enhancements

Private LTC insurance has not historically had high participation rates. Unless that situation changes in the future—such that carriers can provide affordable and eligible products—enhancing the Partnership Program would likely not increase the covered population significantly.

Catastrophic LTC

Such a catastrophic LTC program is anticipated to be mandatory and national. Therefore, it would be expected to broadly increase the population covered. However, the program would not address the needs of nonworkers or the current or nearly elderly.

Criteria #2: Comprehensiveness of Benefits—Are benefits sufficiently comprehensive without encouraging overutilization?

Adding LTC benefits to Medigap and Medicare Advantage Plans

Such a proposal is likely to provide a limited lifetime benefit of less than a year. Lack of underwriting may lead to over-utilization but could be somewhat mitigated by coordination of acute and long-term care needs. Over-utilization could further be mitigated if the LTC benefits are only available for new Medicare participants.

The Washington State Program

The benefits covered for each participant are quite limited and may not protect participants from severe long-term care needs.

Partnership Program Enhancements

While Medicaid utilization by consumers who purchase Partnership-eligible products could increase, this increase would occur after the private insurance program benefits are exhausted. It is likely these enhancements would cause a decrease in overall Medicaid spending.

Catastrophic LTC

A catastrophic LTC proposal typically covers claims after an average waiting period of two years. Private insurance might be used for these initial years. Claim utilization could increase given the short claim exposure managed by insurance carriers and the use of cash benefits within the catastrophic plan.

Criteria #3: Quality of Care Benchmarking and Monitoring—Does the program promote quality of care and coordination with other available services?

Adding LTC benefits to Medigap and Medicare Advantage Plans

Given the limited LTC benefits expected to be offered in both Medigap and Medicare Advantage plans, the ability to monitor quality in long-duration claims would also be limited. However, coordination of chronic and acute care services could be enhanced under Medicare Advantage plans, as they provide a single funding source for these services.

The Washington State Program

The health care authority is charged with establishing rules and procedures for benefit coordination when the eligible beneficiary is also eligible for Medicaid and other LTC supports, including Medicare and private long-term care coverage.

Partnership Program Enhancements

The Partnership Program is specifically designed to leverage the design and claim administration of standalone LTC policies and to coordinate between long-term care insurance and Medicaid.

Catastrophic LTC

While quality of care is not directly addressed, the proposal could reduce the burden on Medicaid and has the potential to coordinate with private LTC insurance to fill gaps in early care needs given that the tail risk is covered by a public program.

Criteria #4: Understandability and Choice—Are the choices in the program easy to understand and does the program add to consumer choice?

Adding LTC benefits to Medigap and Medicare Advantage Plans

Standardized LTC benefits would be relatively easy to understand. The choice with respect to the plan would necessarily be limited in order to avoid adverse selection. Individuals will have to determine whether the offering fits their LTC needs for the premium charged, or whether other coverage and another Medicare option (such as Medicare Advantage or standard Medicare) is more appropriate.

Current benefits offered in Medicare Advantage are generally very limited. While the benefits may be easy to understand, there is potential for misunderstanding the amount of coverage an individual has for LTC.

The Washington State Program

The benefits are relatively simple. The lifetime benefit maximum of $36,500 starting in 2025 is indexed at the Washington state consumer price index. The basic eligibility for the program is relatively simple, but some of the vesting and rules for moving in and out the state can be complex. There is not any consumer choice with respect to benefits. The only choice with respect to eligibility is for those opting out of the program because they have other LTC coverage, or for self-employed individuals who opt in to the program.

An individual’s ability to discern their needs, limitations, and availability of assistance when deciding to participate in the program (if they are one who has an option) requires education on the program and general knowledge and forethought with respect to LTC needs.

Partnership Program Enhancements

The enhancements with respect to inflation and other LTC offerings are relatively simple and would allow for broad consumer choice. However, the Partnership program would benefit from additional education to increase consumer awareness and understanding of the program.

Catastrophic LTC

The benefits can be explained as being relatively simple (although more complex variations and designs are possible). If choices with respect to benefit levels are provided, the complexity increases. The potential of varying the deductible by income level adds complexity to both understanding and administration. An individual’s ability to discern their needs, limitations, and availability of assistance require general knowledge of LTC and the ability to align that knowledge with the program offering and depend partly on the degree of choice and complexity in the final design of the catastrophic program.

Criteria #5: Affordability—Is the program’s funding mechanism affordable to the population it is intended to reach?

Adding LTC benefits to Medigap and Medicare Advantage Plans

Adding LTC coverage to Medigap and/or Medicare Advantage plans as either an optional benefit or a required benefit would increase the premiums of these supplemental plans, and consequently seniors may opt for lower coverage options or seek alternatives. This may lead to consumers choosing lower levels of acute care coverage and could impact the sustainability of the overall programs.

The Washington State Program

The Washington State program is funded with an initial “premium” equal to 0.58% of employees’ wages. Although the premium rate may change in the future, it will be capped at 0.58% of wages without legislative action and therefore benefits may need to be reduced. Because the program requires participation starting at an early age, this may keep the total cost of the program affordable to the participants.

Partnership Program Enhancements

Enhancements directly target the affordability of current Partnership Plans by proposing to ease the mandate of a 5% annual inflation provision. However, private insurance carriers would also need to participate with products that attract those that are more likely to rely on Medicaid long-term care benefits.

Catastrophic LTC

Financing would come from a premium surcharge on the Medicare tax, currently estimated at 1% and assessed to all workers. Waiting periods to receive benefits would be longer (e.g., up to four years) for higher-income individuals. Therefore, the program would address affordability by allowing lower-income individuals to pay lower premiums in absolute dollars yet be able to access benefits sooner in their need for care.

Criteria #6: Risk Management and Cost Control—How are risks and costs managed? If funded by tax revenues, does it enhance state or federal program budget?

Adding LTC benefits to Medigap and Medicare Advantage Plans

The ability to coordinate both acute and custodial care would be likely to reduce acute care claims and could help reduce both recurring acute needs and LTC needs overall.

The Washington State Program

Tax revenue cannot be used for other purposes. If an actuarial certification of solvency cannot be done, benefits under the program would be cut or legislative action would be necessary to increase the payroll tax, as needed. Other measures, such as audits, service verification, provider registration and caregiver training are also expected to be put in place.

Partnership Program Enhancements

If carriers participate and Partnership Plans are then able to increase participation, Medicaid programs would save expenses on LTC costs, thus these changes should help state and federal budgets.

Catastrophic LTC

Making the coverage mandatory would limit adverse selection. As with other social insurance programs, existing workers may fund retired claimants such that demographic shifts could adversely affect the availability of program funds for future claimants.

Criteria #7: Financial Soundness and Sustainability—Is the proposed program sustainable when considering the funding approach and the potential for adverse risks?

Adding LTC benefits to Medigap and Medicare Advantage Plans

Sustainability would depend on the level of LTC benefits introduced and whether LTC benefits are required in all plans offered. Current Medicare Advantage plans have added relatively limited LTC benefits to minimize adverse selection and increase affordability. However, there are concerns for the sustainability of the offering if adverse selection occurs due to offering optional LTC benefits.

The Washington State Program

The program allows for decreases in benefits to maintain a sustainable program. Increases in the payroll tax may be passed by legislation to maintain the same benefits. The program is susceptible to challenges of similar social insurance programs where the currently working may fund existing retirees and claimants. Therefore, demographic shifts could pose a significant risk to the program. The program would need to monitor potential demographic shifts.

Enhancing Partnership Program Enhancements

The Partnership Program is meant to reduce the burden on Medicaid. The program can remain sustainable if private insurance options remain viable. This may occur if the availability and the types of Partnership-eligible insurance products increase for individuals who would potentially use Medicaid long-term care services.

Catastrophic LTC

Such a mandatory catastrophic LTC proposal carries with it a 1% payroll tax, which may increase as experience emerges. Benefits would be cash-based and have an elimination period that is based on income at the time of claim. Income in retirement may not be predictable and therefore could create an uncertain level of benefits. Furthermore, there would not be a benefit for nonworking spouses or those that do not qualify and therefore Medicaid sustainability would continue to be stressed.

Related Considerations: Demographics, Needs, and Preferences

In addition to the criteria identified by the Academy previously, other LTC reform proposal considerations include demographics, the need for long-term care services, and the preferences of individuals and families.

- Demographics—In an effort to gain insight into private LTC insurance purchasing decisions, several industry studies have been performed to qualify or quantify purchasing behavior. These studies commonly segment the market based on demographics. Segments include age, gender, race/culture, income, employment, and marital status.

Such studies have found differences in behavior between these demographic segments. For example, reviewed data by gender, age, race and income. Some of the resulting statistics and observations are as follows:15

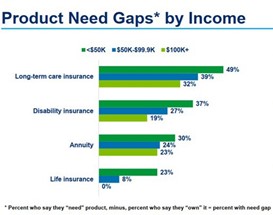

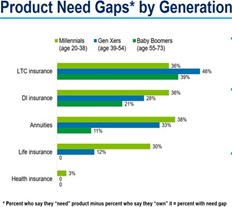

- LTC shows an average ownership rate of 14%, which is lower than both life insurance (59%) and disability insurance (25%). Ownership rates vary noticeably by age, gender, income, and race/culture. For example, the study shows an increase in ownership rate by income level.

- The ownership gap between coverage that is “needed” versus coverage that is “owned” is the highest for LTC. The ownership gaps show disparities by gender, generation, race and culture. For example, the study shows a decline in ownership gap as income increases.

- Generally, lower-income households are more concerned about affordability, while higher-income households are more concerned about asset protection and expenses

Given these differences between demographic groups, LTC reform proposals should consider the different demographic segments and take into account how the ownership gap by segment can be addressed.

- The need for LTC—The amount and duration of LTC events varies greatly. One study16 examined the need for care at HIPAA17 levels (i.e., requiring assistance with two or more activities of daily living (ADLs) or a severe cognitive impairment). Study simulations show that 47% of individuals aged 65 will not need care at the HIPAA level, approximately a quarter will need care at HIPAA levels for less than two years, 12% will need care between two and five years, and 14% will need care for more than five years.

An LTC financing reform proposal should consider how a public program alone or combined with private insurance would address the various needs. For example,

- Should the public program be designed to cover short-duration needs?

- Should the public program be designed to cover only the catastrophic needs (e.g., benefits exceeding the number of years that is expected to be funded by private insurance or individual assets)?

- What level of disability qualifies for benefits?

- Should the public program be tailored to a specific population segment or provide benefits for all?

- Preferences—An LTC reform proposal should also consider preferences. One survey18 shows that price is the No. 1 consideration in making insurance purchase decisions.

Considerations for proposals include:

- How would it be funded? Would the participants pay premiums, or would it be financed by a tax?

- What are the members’ preferences in terms of level and type of benefits?

- Would preventive care and informal care support be included?

- Would a mandatory program generally be appealing?

- How might members react to potential underwriting requirements?

- How might members react to a waiting period or deductible?

- Would the program(s) provide for the LTC needs of family members such as nonworking spouses and adult children?

- In the event the participant doesn’t have a long-term care need, what other support or benefits are possible (e.g., preventive care, coordination with acute care needs)?

- How would the public be educated generally on the public program, including on its limitations and the expected level of personal responsibility in light of the limitations?

Conclusion

As the U.S population continues to age, proposals for financing long-term care protection evolve. Clearly there is not a single solution that will meet the needs of the entire population and address the criteria elements and related considerations presented above. Public programs and initiatives can fill the gaps and reduce inefficiencies if designed with the right considerations and criteria in mind.

|

[1] The terms “long-term care” and “long-term services and supports” are commonly used to reference care and support for individuals with activities of daily living (ADL) and/or severe cognitive impairment needs. Within this issue brief, “LTC” is used to reference such. [2] “Opinions and a Conversation on LTC Financing”; Long-Term Care News; Society of Actuaries; September 2012. [3] Essential Criteria for Long-Term Care Financing Reform Proposals; American Academy of Actuaries; November 2016. [4] Social Security Programs in the United States; Social Security Administration Office of Research, Evaluation and Statistics; July 1997. [6] “Medicaid and Long-Term Services and Supports: A Primer”; Kaiser Family Foundation; December 2015. [7] A means test is a determination of whether an individual or family is eligible for government assistance, based upon level of income and assets. The threshold may vary by state and calendar year. [8] Second Substitute House Bill 1087; Washington State Legislature; 2019. [9] Based on a review of publicly available cost of care surveys. [10] A tax-qualified LTC insurance product is defined by Section 7702B(b) of the Internal Revenue Code and identifies a chronic illness benefit trigger as requiring deficiencies at least two of six activities of daily living or a severe cognitive impairment. [11] IADL is an abbreviation for Instrumental Activities of Daily Living and include handling medications, housekeeping, shopping, and using the telephone. [12] A New Vision for Long-Term Services and Supports; LeadingAge; 2017. [13] A New Public-Private Partnership: Catastrophic Public and Front-End Private LTC Insurance; Bipartisan Policy Center; January 2018. [14] Based on a review of publicly available cost of care surveys. [15] Insurance Barometer Study, 2019, LIMRA and Life Happens. Reprinted with permission. [16] Long-Term Services and Supports for Older Americans: Risks and Financing Research Brief; U.S. Department of Health and Human Services; July 2015. [17] Health Insurance Portability and Accountability Act. [18] “Findings From the Survey of Long-Term Care Awareness and Planning Research Brief ”; U.S. Department of Health and Human Services; July 1, 2015. |

Craig Hanna, Director of Public Policy Members of the Long-Term Care Reform Subcommittee, which produced this issue brief, include Steve Schoonveld, MAAA, FSA; Jamala Arland, MAAA, FSA; Peggy Hauser, MAAA, FSA; Al Schmitz, MAAA, FSA; and Linda Chow, MAAA, FSA. |